44+ how much of gross pay should go to mortgage

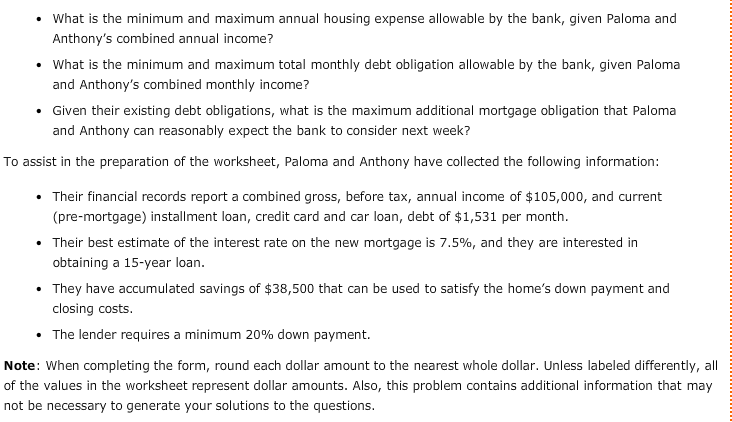

Keep your total debt payments at or below 40 of your pretax monthly income. Web But there are two other models that can be used.

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

How Much Mortgage Can I Afford

On the profitability front gross profit margin jumped.

. TDS looks at the gross annual income needed for all debt payments like your house credit cards personal loans and car loan. This rule says that you should not. Easily Compare Mortgage Rates and Find a Great Lender.

John in the above example makes. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. Check Your Eligibility for a Low Down Payment FHA Loan.

In general lenders follow the 28 percent rule meaning no more than 28 percent of your gross income should go to your mortgage. Save Time Money. Web The 28 Percent Rule.

Looking For a House Loan. Web 28 of Gross Income. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Web But with most mortgages lenders will want you to have a DTI of 43 or less. Browse Our Wide Range Of Products At Competitive Rates And Low Down Payment Options. That might sound exciting at first but with a.

Web Front-end DTI measures how much of your monthly gross pre-tax income goes toward your mortgage payment both principal and interest property taxes and mortgage. Figure out 25 of your take-home pay. Web It recommends you spend up to 50 of your monthly after-tax income aka net income toward essential expenses needs like your mortgage payment utility bills.

Web 1 hour agoContinuing its superb execution in 2022 MercadoLibre grew its year-over-year revenue by 53 to 105 billion. You already pay 1000. Never spend more than 25 of your monthly take-home.

Comparisons Trusted by 55000000. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. My boyfriend and I are both paying extra on it 200week from the both of us.

Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage. Ad Apply Online Today For A Diverse Mortgage Solution To Navigate Your Home-Buying Process. To calculate how much house you can afford use the 25 rule.

Web Based on your DTI and depending on your other debts you could be approved for a mortgage of 600000. First Time Home Buyer. Save Real Money Today.

A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your. Take the First Step Towards Your Dream Home See If You Qualify. Calculating mine only I pay just over 30 of.

Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income. Web 25 Post-Tax Model. Ad 5 Best House Loan Lenders Compared Reviewed.

Find Out How With Quicken Loans. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Thats a mortgage between 120000 and.

Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Ad First Time Home Buyers.

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Compare Lenders And Find Out Which One Suits You Best. Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage.

Web Total Debt Service TDS Ratio. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. Web Recently bought a house 3bed 2bath 2 car garage.

Thats a mortgage between 120000 and. Ad Own A 150000 Home With A 4500 Down Payment. One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. For example say you have a monthly gross income of 5000. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross.

What Is Fannie Mae Purpose Eligibility Limits Programs

What Percentage Of Income Should Go To Mortgage

Gross Profit Percentage Top 3 Examples With Excel Template

How Much Of My Income Should Go Towards A Mortgage Payment

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

44 Business Ideas In Chennai For 2023 100 Actionable Profit Making Business

What Percentage Of Income Should Go To Mortgage

Cash Flow Vs Net Income Top 6 Differences To Learn

First Community Mortgage Avaleht Facebook

What Percentage Of Your Income Should Go To Mortgage Chase

Tbd Ne 75th St Williston Fl 32696 Realtor Com

Here S How To Figure Out How Much Home You Can Afford

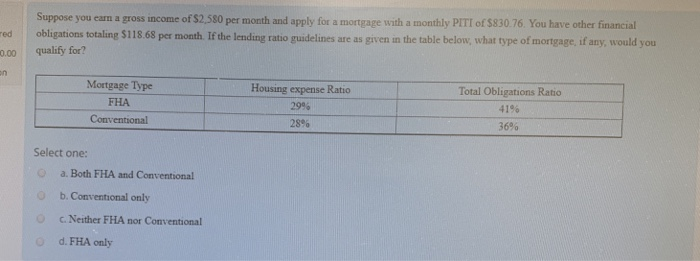

Solved Suppose You Eam A Gross Income Of 2580 Per Month And Chegg Com

What Percentage Of Income Should Go To Mortgage

What Percentage Of Your Income Should Go To Your Mortgage Hometap

Solved First Filling The Blank A Back End B Front End Chegg Com

What Percentage Of Income Should Go To Mortgage Morty